You work hard to deliver outstanding client service. But in a highly competitive and fragmented industry, how can your firm get credit for the efforts and investments made towards delivering consistently remarkable service? What steps can you take to demonstrate and prove your commitment to your clients and prospects? And how can you leverage the quality of the service you provide to improve firm reputation and accelerate growth?

There’s no single answer to these questions, but there are resources that your firm can employ to harness client satisfaction for growth. One such resource is a single metric known as the Net Promoter® Score, or “NPS®” for short.

What is NPS®?

Chances are you’ve heard of NPS before, and whether you realize it or not, you’ve probably participated in an NPS survey.

NPS is a simple metric based on a single survey question that asks your clients how likely they are to recommend your firm to a friend or colleague using a numeric scale of 0-10, ten being extremely likely and zero being not at all likely.

Responses to this question are divided into three categories:

- Promoters are clients who answer with a 9 or 10, which means they are highly satisfied with your services and are loyal to your firm. Promoters represent your strongest allies and are most likely to be active in promoting your firm to others.

- Passives are clients who answer with a 7 or 8, meaning that they may be satisfied but demonstrate an indifference to their experience with your firm. Passives, while not as immediately detrimental as detractors, represent a risk to retention and firm reputation. Put frankly, they cannot be expected to be loyal to your firm or promote your services to their own network.

- Detractors are clients who answer with a 0 through 6, signifying they are at elevated risk of leaving your firm to work with a competitor. Not only are you at risk of losing the business of detractors, they are also the most likely to share negative feedback to their networks regarding their experience with you.

You calculate your firm’s “score” by subtracting the % of detractors from the % of promoters in your set of responses.

NPS for Accounting Firms

The fact of the matter is a very small portion of accounting firms survey their clients with any regularity, and only some of those utilize NPS to power their feedback. But NPS has been around for a long time. The concept was created by Fred Reichheld at Bain & Company and Satmetrix, and was later introduced as the Net Promoter® Score methodology in 2003 when Fred published an article in the Harvard Business Review called “The One Number You Need to Grow.”

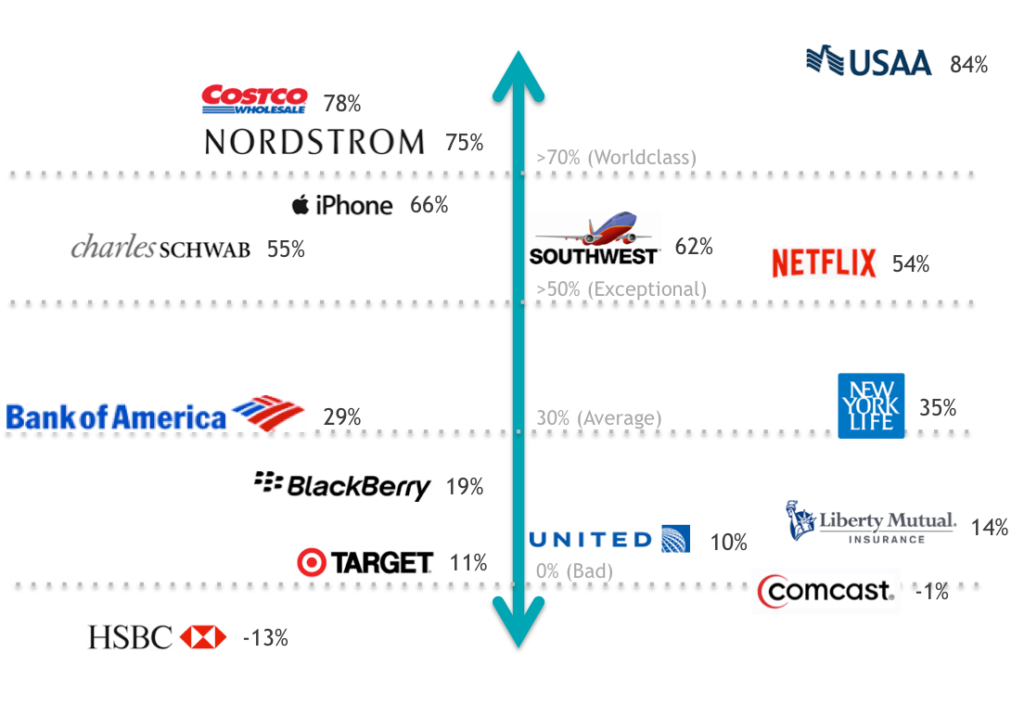

Since then, NPS has gained momentous traction across industries as a way to benchmark service quality, improve retention, and build company reputation. Here’s a quick reference chart that shows published NPS scores for some brands you probably know:

So why has NPS struggled to gain traction in the accounting industry? Below are a 3 common objections we field from accounting leaders hesitant to move their firms in this direction (and the conversations that typically arise from them):

- Objection #1: Surveys are too impersonal compared to client interviews.

No doubt, nothing beats an in-person, one-on-one conversation for relationship-building. An online survey doesn’t replace these conversations, it enhances them by allowing you to start a review with a top client by already understanding their service concerns and experiences. Our 2018 Accounting Industry Benchmark Study finds that 73% of accounting clients are more likely to give feedback to their service provider through an online survey than a face-to-face (or voice-to-voice) interview. That’s a dramatic change in sample size from an interview strategy alone. What’s more, 65% of clients say they are more candid when providing feedback via online than they are in-person, providing you with a more transparent diagnosis of your relationships. Last, but certainly not least, by standardizing the inquiry you can also standardize reporting. Imagine having the ability to compare client satisfaction and service quality by location, by practice area, and even by practitioner. That’s the power of NPS.

- Objection #2: We don’t have enough time to address client feedback (positive or negative).

This concern is incredibly valid, and often makes or breaks whether a firm decides to continue on with their NPS program. One of the most common frustrations we hear from firms who have implemented NPS with a “self serve” survey product like Survey Monkey or Delighted is that they spent way more time and energy setting up and sending the survey than they do change or the addressing concerns (end value) on the back end. Many who use a self serve strategy spend 80 percent of their time on managing the survey, and only 20 percent on improving. Those numbers should be swapped. One strategy to help you avoid falling into this trap is to work with a software that triggers your team to take action on specific events (like a detractor response or a promoter who is willing to share a testimonial) and building a process around this support. You can always reach out to my team to schedule a demo of the My.Inavero survey platform to see an example of this. - Objection #3: I can’t justify the dollars and time required to deploy an NPS initiative.

Allow me to be blunt: you will be hard-pressed to justify an ROI if your firm is solely-focused on resolving service issues. What many accounting leaders may fail to realize are the opportunities to go beyond measurement with NPS. A well-designed NPS survey program should place your firm’s service levels at the center of your marketing strategy – from retention and account growth to differentiation and improving your online search results. Going further with NPS includes: promptly addressing any issues with detractors; celebrating and encouraging promoters to help build your firm’s reputation; incorporating feedback and testimonials from your NPS initiative for use in marketing collateral and sales conversations; and cultivating a firm-wide passion (maybe even obsession!) for service quality and delivering consistently remarkable client service. Consider partnering with a survey provider who has demonstrable experience with administering NPS in your industry to ensure you capitalize on these benefits.

Next Steps with NPS

Before embarking on a client satisfaction survey or NPS initiative, it’s important that you understand your goals, your strategy, and best practices for success. If you would like access to a list of considerations for a successful program, consider downloading Inavero’s Satisfaction Survey Checklist for Accounting Firms. Alternatively, you can always reach out to Inavero to have a conversation with one of our experts about implementing NPS at your firm.

Last but not least, I’ll be co-hosting a webinar, “From Service Measurement to Service Excellence,” with Adelaide Ness of The Rainmaker Companies on February 13 at 2:00 pm Central. I hope you’ll join us! Register here.

About the Author:

About the Author: Eric Gregg is the founder and CEO of Inavero, a leading provider of client satisfaction surveys service quality research in the accounting industry. Inavero strives to bring meaningful insights and actionable best practices to accounting leaders across North America, helping them improve client satisfaction and differentiate on service quality. Learn more at www.inavero.com